31+ credit score for mortgage loan

Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Web 1 day ago2.

The Credit Score You Need To Take Out A Mortgage

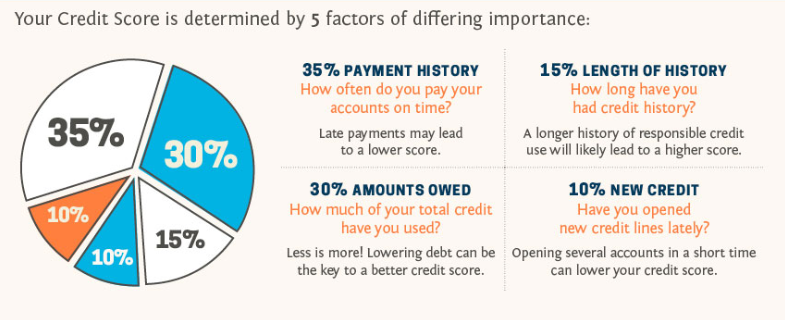

Various financial factors are included.

. Fixed Rate Products Only. It Only Takes 3 Monutes To Get a Rate 25 Days To Close An FHA Loan. Web On a joint mortgage all borrowers credit scores matter.

Web Your credit score is only one factor that goes into determining your mortgage rate. Web Heres 5 easy steps to getting a no credit score loan. Its recommended that homebuyers have.

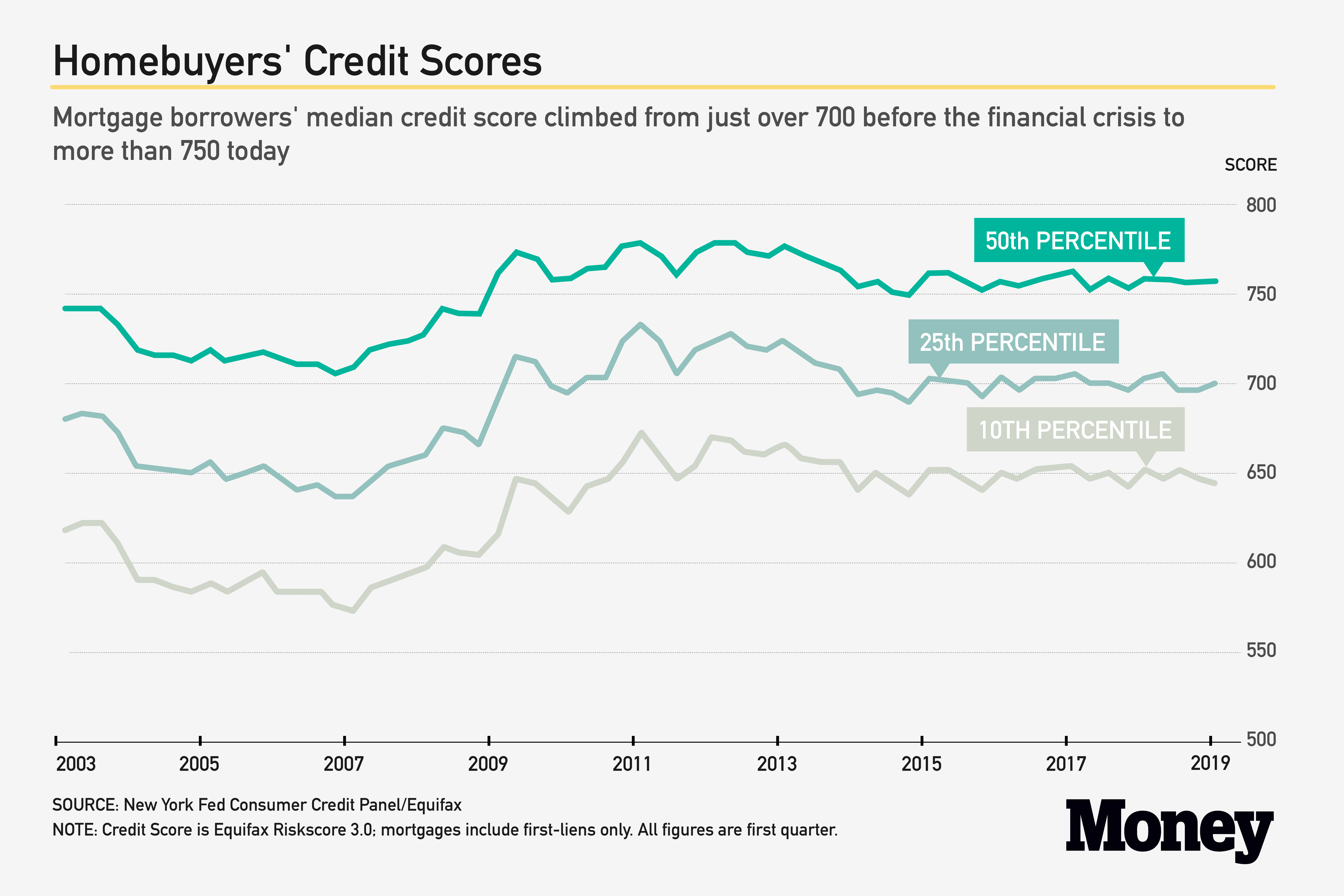

620 to 720 depending on loan type and lender Conventional mortgages make up the majority of all home loans and are issued. If your credit score falls into this category you may find that some lenders are. Web Minimum credit score to refinance.

Determine how much you want your mortgage payment. Lenders collect credit and financial information including credit history current debt and income. Web The best mortgage rates generally apply to those with a solid credit history that demonstrate responsible management of debt.

Web A favorable credit score to buy a house is typically in the high 600s and 700s. Web In the United States a conventional mortgage loan typically requires a minimum credit score of 620 or higher. Take the First Step Towards Your Dream Home See If You Qualify.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. If your credit score falls below that you can still get a.

Web Enter a 200000 principal on a 30-year fixed-rate loan and your credit score ranges mortgage rates and overall costs might look something like this as of. Check Your Official Eligibility Today. Ad Compare the Best House Loans for March 2023.

Find A Lender That Offers Great Service. Ad Updated FHA Loan Requirements for 2023. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

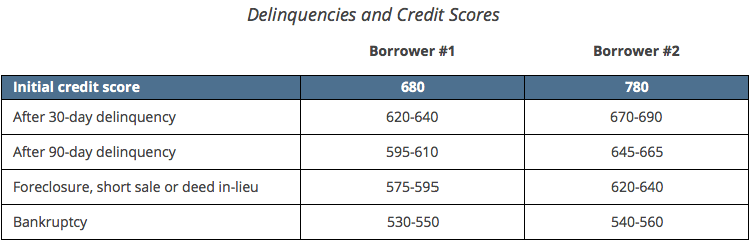

Web A poor credit score is often defined as a score below 600 on a 300 850 scale. Compare More Than Just Rates. Ad Compare the Best House Loans for March 2023.

Web To qualify for a low down payment mortgage currently 35 youll need a minimum FICO score of 580. One of the first things a lender will look at is your credit score which reflects your history of repaying your debts. 580 if you want to put down 35.

Apply Get Pre-Approved Today. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Low Down Payment only 35.

Web Paying your mortgage Even if your credit score takes a hit after applying for your mortgage you can bring it back up by making all your mortgage payments and. Web A poor credit score is often defined as a score below 600 on a 300 850 scale. Get Instantly Matched With Your Ideal Mortgage Lender.

Fill out the form and connect with one of our Home Loan Specialists. No SNN Needed to Check Rates. Other important factors include your loan type loan term eg.

Get extra cash for home. Ad See what your estimated monthly payment would be with the VA Loan. An FHA loan is a type of private mortgage thats guaranteed by the Federal Housing Administration.

Web Zero Credit Score One or Both Borrowers. Debt to Income 31 43. Web Different mortgage types have different minimum score requirements.

Web 31 Loan Agreement Templates Word Pdf Pages. Apply Get Pre-Approved Today. Anything higher than that is considered exceptional and helps borrowers get the very best.

Lock Your Rate Today. Web Credit score. The Best Lenders All In 1 Place.

Low Fixed Mortgage Refinance Rates Updated Daily. With Low Down Payment Low Rates An FHA Loan Can Save You Money. Ad First Time Homebuyers.

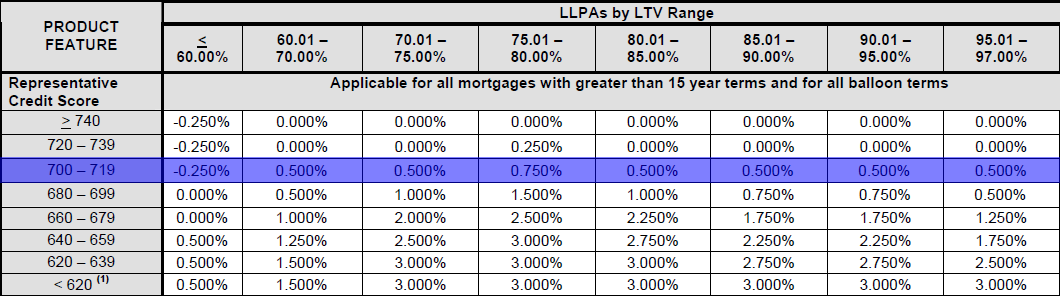

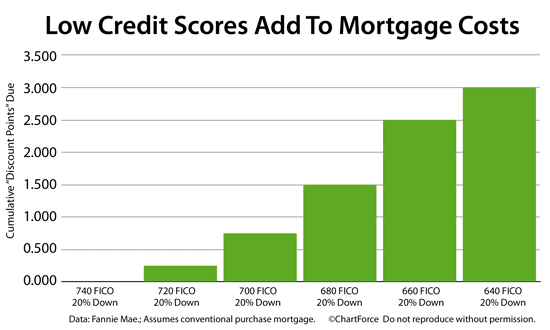

Web On a 30-year fixed-rate mortgage for 150000 having a credit score of 620 to 639 could cost you tens of thousands of dollars more over 30 years compared to. 30 or 15 years and the current. Lock Your Rate Today.

It has one of. However to qualify for the best interest rates. Must Meet FHA Alternative.

Most lenders look for a credit score in at least the good range to approve a. 500 if you can put down 10. Web A 30-year conventional mortgage in the 200000-250000 range might on average cost a borrower with a credit score between 680-699 40000 more in total.

What Credit Score Do You Need To Buy A House Bankrate

Credit Score Needed To Get A Home Loan Credible

What Is A Good Credit Score To Get A Home Loan Marketwatch

The Mortgage Porter Is 714 A Good Credit Score For Buying A House

Pin On Savings Side Gigs Financial Success

Free 31 Credit Application Forms In Pdf

Credit Score Under 740 Prepare To Overpay On Your Mortgage

Lbcer8kex992 2020q4

The Average Credit Score For Approved Mortgages Is Declining

What Credit Score Do You Need To Buy A House Nerdwallet

What S The Credit Score Needed To Buy A House In 2021

5 Ways To Quickly Improve Your Mortgage Credit Score

Chapter 9

This Is The Credit Score You Need For A Mortgage Money

What Credit Score Is Needed To Buy A Home

What Credit Score Do You Need To Buy A House Nerdwallet

Credit Score Needed To Get A Home Loan Credible